Why is public EV charging getting so expensive?

Record high power prices are passed on to charging networks

The wholesale electricity price is set by gas, which means that even the price of solar or wind power is impacted by rising gas prices.

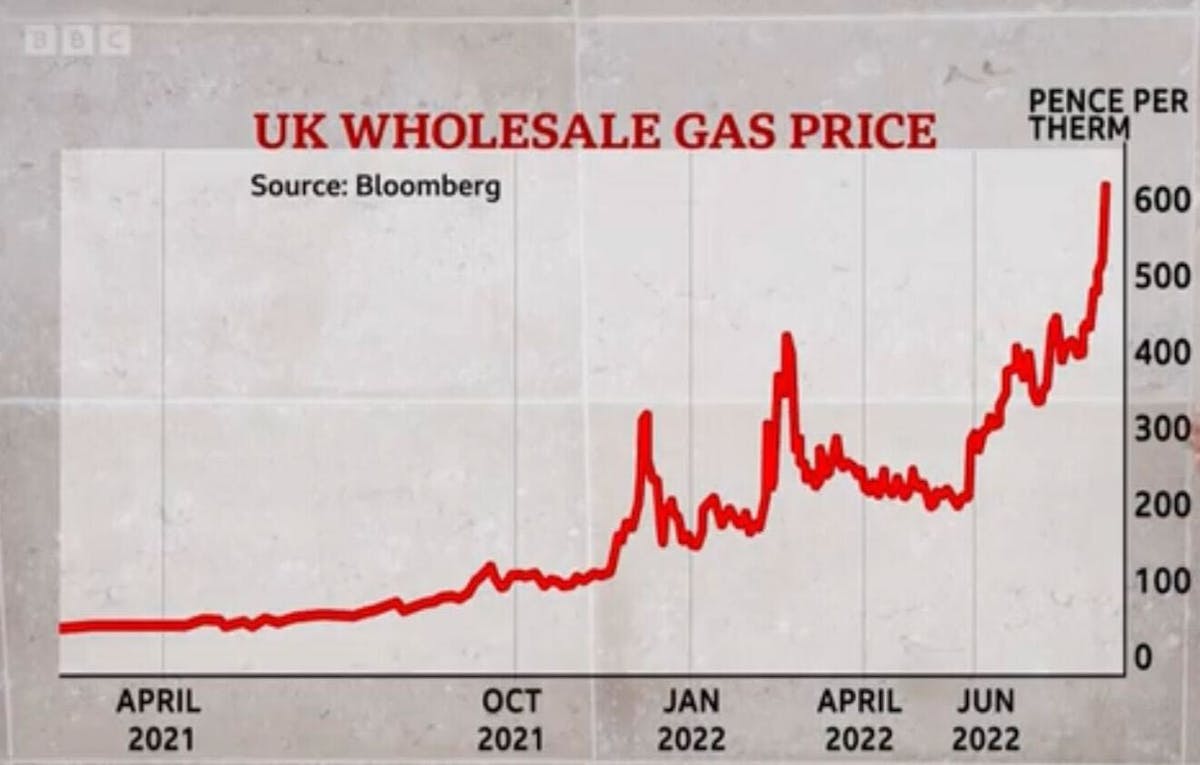

Gas prices have been increasing primarily due to the Russian invasion of Ukraine and the cut in their gas supply to Europe, coupled with high demand and stockpiling by countries in preparation for winter.

Record gas prices (8x higher than a year ago) have in turn, therefore, sent UK electricity prices sky-high.

Charging point operators (CPOs), a bit like consumers, buy from energy suppliers so are subject to the prices they offer: and we can choose whether to fix long-term or not, which we cover below.

Unlike consumers, however, there is no price cap for businesses. So energy suppliers can pass on much more of the high wholesale prices that they themselves buy ahead at.

There is an unsolvable fix-vs-flexible price decision.

CPOs have a choice to fix over a longer time period with an energy company, or stay flexible tracking more closely the wholesale price.

Whilst flexibility means a very high price now (due to energy suppliers themselves buying at current high prices), it is expected to come down in future.

The risk is when and how much the prices come down – is it enough to offset riding out astronomical prices now? This is difficult to predict due to uncertainty around the war in Ukraine and Europe’s winter gas levels.

Fixing on the other hand gives predictability of price and smooths out fluctuations: in the current market a CPO would pay less than market rate now but likely above the market rate down the line.

The risk is that once fixed, if prices drop dramatically later such that an energy supplier can offer something cheaper, the CPO cannot change to it. There is therefore less opportunity to pass on future lower prices to customers, until the fixed period is over. The CPO may be stuck paying a much higher amount than market rate later, that is not offset by lower price now.

It is very difficult to predict what will happen in the uncertain circumstances affecting the gas price, and therefore very difficult to take a decision that safely maintains a lower price for our customers through the year ahead.

VAT at 20% means no saving passed on to customers.

The price you pay at the EV charger is comprised of the CPO’s electricity cost, VAT and a small margin to cover infrastructure, maintenance and operating costs. Very few, if any, CPOs are profitable at this stage of the market.

We’ve explained the astronomical increase in energy prices, but what about VAT?

VAT is at 20% for public charging, vs 5% for home energy. A year ago, an average rapid charge would have given the govt £1.90 in VAT. Today, that same charge gives the govt £2.90 in VAT.

This, coupled with high energy costs, squeezes the margin that we can add to the energy price without it become inhibiting high for our customers. That margin is not profit, it covers the cost of installing and running high-power charging infrastructure (between £500,000 to £1,000,000 per site).

20% VAT in the current energy crisis therefore jeopardises the roll-out of high-quality, reliable charging infrastructure for the UK.

We are, together with peers, lobbying for the public charging VAT to be reduced to 5%. This could be passed on to customers via reduced prices and would save a collective £46m (to end 2023), going some way to helping consumers continue to choose electric in the face of high electricity prices.

Otherwise, we estimate that total VAT payable on charging will more than double from £16.3m in Jul21-Jun22 to £38.3m in Jul22-Jun23.

More insights.

Keep up with the latest insights from Osprey Charging Network.